Things about Amur Capital Management Corporation

Things about Amur Capital Management Corporation

Blog Article

7 Easy Facts About Amur Capital Management Corporation Described

Table of ContentsThe Buzz on Amur Capital Management CorporationSome Known Facts About Amur Capital Management Corporation.The Single Strategy To Use For Amur Capital Management CorporationNot known Facts About Amur Capital Management CorporationExamine This Report on Amur Capital Management CorporationNot known Details About Amur Capital Management Corporation

The firms we follow require a solid track document typically a minimum of 10 years of operating background. This indicates that the firm is most likely to have actually faced at the very least one financial recession which administration has experience with adversity in addition to success. We seek to exclude companies that have a credit report top quality listed below investment grade and weak nancial strength.A firm's capability to elevate dividends continually can demonstrate protability. Firms that have excess cash money ow and strong nancial positions usually select to pay rewards to bring in and compensate their investors.

The 9-Minute Rule for Amur Capital Management Corporation

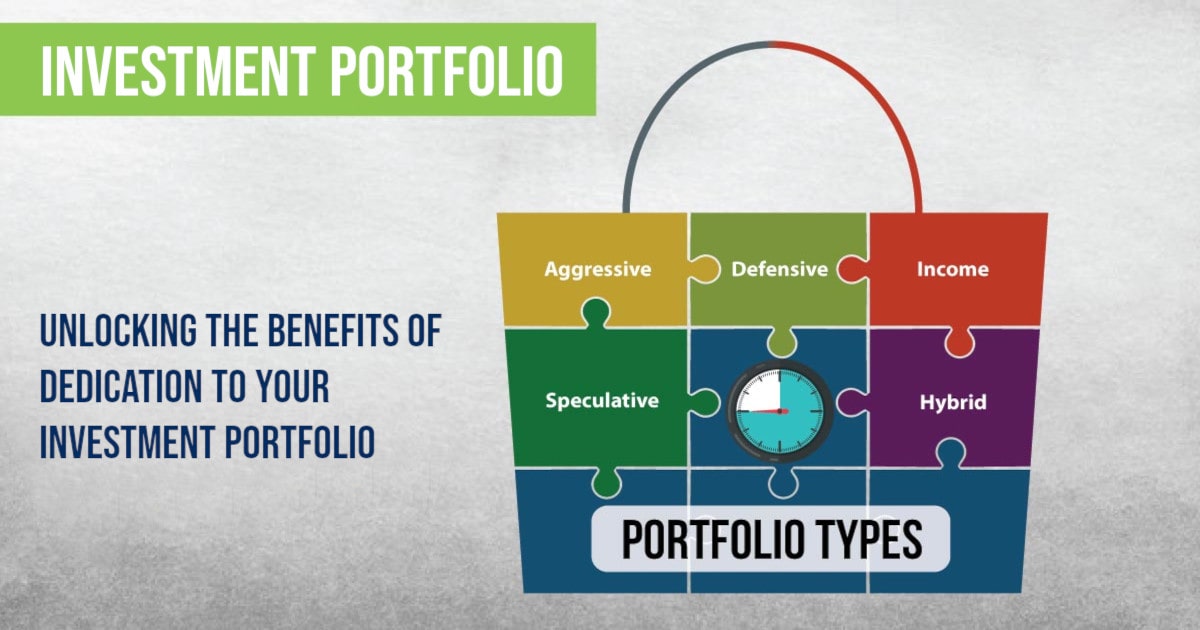

We have actually found these stocks are most in danger of cutting their rewards. Expanding your financial investment portfolio can assist shield against market uctuation. Consider the list below variables as you plan to diversify: Your portfolio's possession class mix is just one of one of the most important consider determining performance. Check out the dimension of a business (or its market capitalization) and its geographical market united state, established worldwide or arising market.

Despite how easy digital financial investment management platforms have actually made investing, it should not be something you do on a whim. Actually, if you make a decision to go into the investing globe, one point to think about is how much time you actually intend to spend for, and whether you're prepared to be in it for the long run.

There's an expression common associated with investing which goes something along the lines of: 'the sphere may drop, however you'll want to make sure you're there for the bounce'. Market volatility, when financial markets are going up and down, is a common sensation, and long-lasting can be something to assist smooth out market bumps.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Joe invests 10,000 and gains 5% reward on this financial investment. In year two, Joe makes a return of 525, since not only has he made a return on his initial 10,000, however likewise on the 500 invested dividend he has gained in the previous year.

Amur Capital Management Corporation - An Overview

One means you could do this is by getting a Stocks and Shares ISA. With a Supplies and Shares ISA. capital management, you can invest up to 20,000 each year in 2024/25 (though this is subject to change in future years), and you do not pay tax obligation on any returns you make

Beginning with an ISA is really easy. With robo-investing platforms, like Wealthify, the effort is provided for you and all you need to do is choose just how much to spend and pick the danger level that fits you. It may be just one of minority circumstances in life where a much less psychological approach could be advantageous, yet when it comes to your finances, you might desire to listen to you head and not your heart.

Staying concentrated on your lasting goals might aid you to prevent irrational decisions based upon your emotions at the time of a market dip. The statistics do not lie, and lasting investing can include numerous advantages. With a composed strategy and a long-term financial investment method, you can potentially expand even the smallest amount of cost savings right into a decent amount of money. The tax therapy depends on your private conditions and might why not check here undergo alter in the future.

The Buzz on Amur Capital Management Corporation

However spending goes one action additionally, assisting you attain individual goals with 3 significant advantages. While conserving means establishing aside component of today's money for tomorrow, spending ways putting your money to work to possibly earn a far better return over the longer term - capital management. https://www.find-us-here.com/businesses/Amur-Capital-Management-Corporation-Surrey-BC-British-Columbia-Canada/34034437/. Various courses of investment assets money, taken care of interest, home and shares usually create various degrees of return (which is about the risk of the financial investment)

As you can see 'Growth' assets, such as shares and building, have traditionally had the most effective overall returns of all possession courses but have also had bigger heights and troughs. As a capitalist, there is the potential to make capital growth over the longer term in addition to a recurring revenue return (like returns from shares or lease from a property).

Unknown Facts About Amur Capital Management Corporation

Inflation is the recurring surge in the price of living over time, and it can affect on our monetary health and wellbeing. One method to assist exceed inflation - and generate positive 'genuine' returns over the longer term - is by purchasing possessions that are not simply efficient in providing higher earnings returns but likewise provide the possibility for resources development.

Report this page